Reason Financial

Getting Out There – A Primer on Camping and Road-Tripping with kids

“I have never been lost, but I will admit to being bewildered for several weeks.” – Daniel Boone

Rainy days in San Diego are my trigger to start planning what we are going to do during the summer. Many of the most popular places from Glacier National Park (MT) to Doheny

Compliance with the Corporate Transparency Act

As we step into 2024, a significant regulatory change is on the horizon that impacts corporations, limited liability companies (LLCs), limited partnerships, and similar entities. Newly formed entities are now required to file a report with the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN), providing detailed information

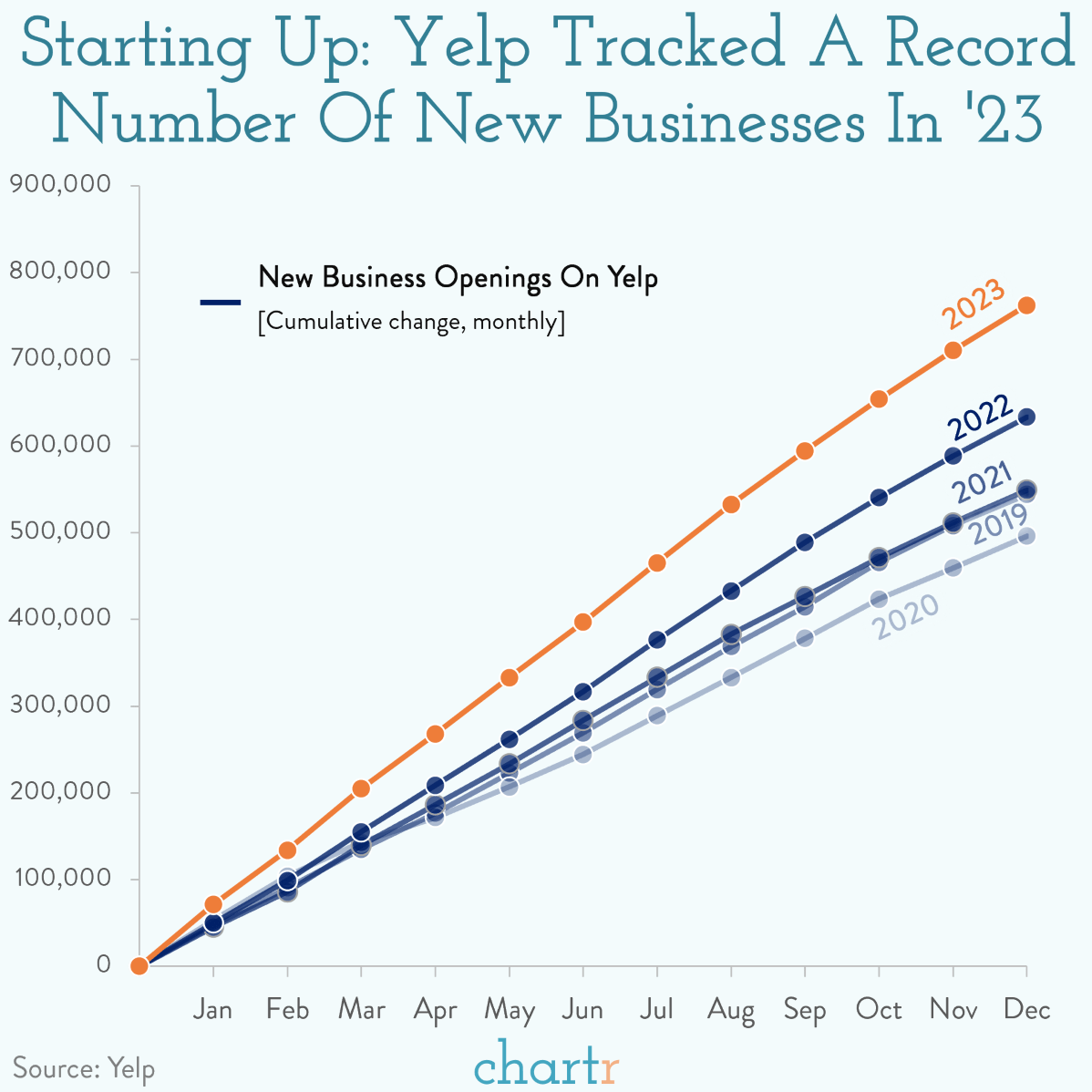

2023 Set A Record

Choosing life insurance to protect your family

Just over half of Americans have life insurance in place—meaning the other half risk leaving their families unprotected in an emergency. Of the folks who do have life insurance, many purchase coverage through their employer. While an employer plan is better than no plan, this approach can create problems

California Business Owners - Statement of Information Filing

California law requires all corporations, limited liability companies (LLC) and common interest development associations to update the records of the California Secretary of State based on the year of registration by filing a Statement of Information (SOI). All entities are required to complete the SOI within the first 90 days

Personal Use of Corporate Automobile

Personal Use of Corporate Automobile

Download your 2024 Personal Use of Auto Information Sheet.

Based on current tax laws, an employee’s personal use of a corporate provided vehicle (PUA) is considered to be a taxable fringe benefit. The following summarizes these rules:

1. A corporation is required to treat